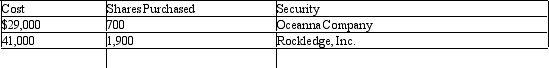

During 2012, its first year of operations, Makala Company purchased two available-for-sale investments as follows:

Assume that as of December 31, 2012, the Oceanna Company stock had a market value of $49 per share and Rockledge, Inc. stock had a market value of $20 per share.

Assume that as of December 31, 2012, the Oceanna Company stock had a market value of $49 per share and Rockledge, Inc. stock had a market value of $20 per share.

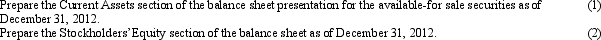

Makala had 10,000 shares of no par stock outstanding that was issued for $150,000. For the year ending December 31, 2012, Makala had a net income of $105,000. No dividends were paid.

Required:

Correct Answer:

Verified

Q104: On October 1, 2012, Marcus Corporation purchased

Q113: On May 1, 2012, Chase Inc. purchases

Q114: Ramiro Company purchased 40% of the outstanding

Q115: On April 1, 2012, ValueTime, Inc. had

Q117: Skyline, Inc. purchased a portfolio of trading

Q120: Sutton Company purchased 10% of the outstanding

Q122: The cost and fair value of the

Q123: Prepare the journal entries for the following

Q124: Journalize the entries to record the following

Q161: Discuss the similarities and differences in reporting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents