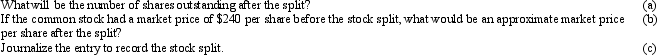

A corporation, which had 18,000 shares of common stock outstanding, declared a 3-for-1 stock split.

Correct Answer:

Verified

Q129: A corporation has 60,000 shares of $25

Q130: Sabas Company has 20,000 shares of $100

Q132: Vincent Corporation has 100,000 share of $100

Q132: A corporation has 50,000 shares of $25

Q136: A corporation has 50,000 shares of $25

Q136: A company had stock outstanding as follows

Q138: Samuels, Inc. reported net income for 2011

Q139: Sabas Company has 40,000 shares of $100

Q171: On April 10, a company acquired land

Q175: On May 1, 10,000 shares of $10

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents