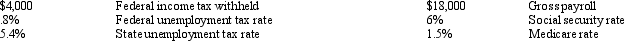

Assuming no employees are subject to ceilings for their earnings, Moore Company has the following information for the pay period of December 15 - 31, 20xx.  Salaries Payable would be recorded for

Salaries Payable would be recorded for

A) $18,000

B) $12,950

C) $12,650

D) $11,534

Correct Answer:

Verified

Q61: The amount of federal income taxes withheld

Q61: The journal entry a company uses to

Q64: Assuming a 360-day year, when a $30,000,

Q67: The current portion of long-term debt should

A)

Q78: Which statement below is not a determinate

Q83: An employee receives an hourly rate of

Q85: Payroll taxes levied against employees become liabilities

A)

Q87: The total earnings of an employee for

Q87: An employee receives an hourly rate of

Q90: Which of the following taxes would be

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents