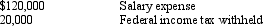

Excel Products Inc. pays its employees semimonthly. The summary of the payroll for December 31, 2012 indicated the following:

For the year ended 2012, $40,000 of the December 31 payroll is subject to social security tax of 6%; $120,000 is subject to Medicare tax of 1.5%; $10,000 is subject to state unemployment tax of 4.3% and federal unemployment tax of 0.8%. As of January 1, 2013 all of the $120,000 is subject to all payroll taxes. Present the journal entries for payroll tax expense if the employees are paid (a) December 31 of the current year, (b) January 2 of the following year.

For the year ended 2012, $40,000 of the December 31 payroll is subject to social security tax of 6%; $120,000 is subject to Medicare tax of 1.5%; $10,000 is subject to state unemployment tax of 4.3% and federal unemployment tax of 0.8%. As of January 1, 2013 all of the $120,000 is subject to all payroll taxes. Present the journal entries for payroll tax expense if the employees are paid (a) December 31 of the current year, (b) January 2 of the following year.

Correct Answer:

Verified

Q162: Journalize the following transactions: Q164: On October 1, Ramos Co. signed a Q165: For Company A and Company B: Q166: The Core Company had the following assets Q168: Journalize the following entries on the books Q169: The current assets and current liabilities for Q170: The summary of the payroll for Q171: Aqua Construction installs swimming pools. They calculate Q171: The following information is for employee Ella Q172: Journalize the following entries on the books

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents