Computation of cash flows

An analysis of changes in selected balance sheet accounts of Taurus Corporation shows the following for the current year:

The income statement for the current year included the following items relating to the transactions summarized above:

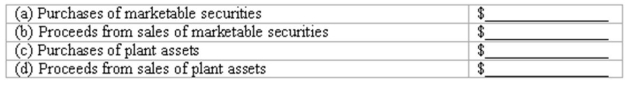

All payments and proceeds relating to these transactions were in cash. Using this information, compute the following cash flows for the current year:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q151: Computation of operating cash flows

The financial

Q152: Computation of cash flows

An analysis of

Q153: Cash flow from operations activities-indirect method

An analysis

Q154: Format of a cash flows statement-direct

Q155: Computation of operating cash flows

The financial

Q157: Cash flows from operating activities-indirect method

The

Q158: Comparison of cash flows and accrual

Q159: Cash flows from operating activities-indirect method

The

Q160: Relationship of cash flows to accrual

Q161: Which of the following is not included

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents