Prepare the stockholders' equity section from transaction data

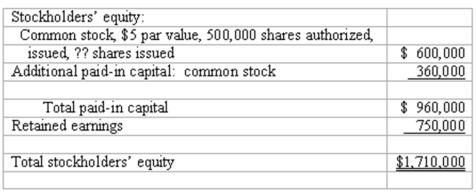

Shown below is the stockholders' equity section of Jone's balance sheet at December 31, 2009.

In 2009, the following events occurred:

Jones issued 2,000 shares of $5 par value common stock in exchange for legal services relating to the formation of the corporation; value of these services was set at $19,500.

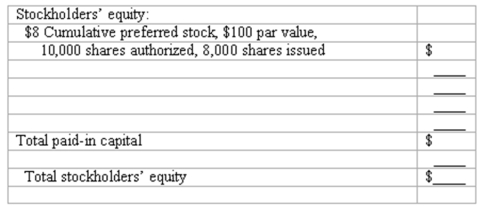

Jones issued 8,000 of its 10,000 authorized shares of $8 cumulative preferred stock, $100 par value, for $108 per share.

The board of directors declared and paid dividends of $8 per share to preferred stockholders and 50 cents per share to common stockholders.

The company's net income for 2009 is $450,000.

Instructions: Complete in good form the stockholders' equity section of a balance sheet prepared for Jones at December 31, 2009.

Correct Answer:

Verified

Q125: Stock values

Presented below is an excerpt from

Q126: Treasury stock transactions.

Jackson Corporation engaged in the

Q127: Prepare journal entries for stockholders' equity transactions

A

Q128: Accounting terminology

Listed below are nine technical accounting

Q129: Refer to the information above. The average

Q131: Interpreting stockholders' equity section

The stockholders' equity section

Q132: Book value per share and other

Q133: Interpreting the stockholders' equity section

The stockholders' equity

Q134: Determining book value per share

Shown below is

Q142: Cash dividends and two classes of stock

Raymond

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents