Fully amortizing installment note payable

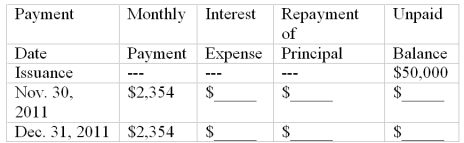

On October 31, 2011 Ronald signed a 2-year installment note in the amount of $50,000 in conjunction with the purchase of equipment. This note is payable in equal monthly installments of $2,354, which include interest computed at an annual rate of 12%. The first monthly payment is made on November 30, 2011. This note is fully amortizing over 24 months.

Complete the amortization table for the first two payments by entering the correct dollar amounts in the blank spaces provided. In addition, answer the questions that follow.

(a) With respect to this note, Ronald's 2011 income statement includes interest expense of $_______________, and Ronald's balance sheet at December 31, 2011, includes a total liability for this note payable of _______________. (Do not separate into current and long-term portions.)

(b) The aggregate monthly cash payments Ronald will make over the 2-year life of the note payable amount to $_______________.

(c) Over the 2-year life of the note, the amount Ronald will pay for interest amounts to $_______________.

Correct Answer:

Verified

(a) With respect to this note, Ronald's...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q99: Employees' annual "take-home-pay," totals approximately:

A)$642.800.

B)$760,000.

C)$681,200.

D)$658,800.

Q178: Notes payable

On September 1, 2009, George Hanby

Q179: The carrying value of this liability in

Q181: Bonds payable-issued between interest dates

Barney Corporation received

Q182: How much must Central Food pay the

Q182: Bonds issued at par - basic concepts

On

Q185: The liability for this loan as of

Q186: Bonds issued at par - basic concepts

On

Q187: The LBB Company recently took a mortgage

Q192: Operating and capital leases

Berkeley Corporation wants to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents