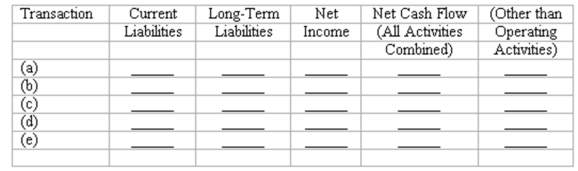

Effects of transactions upon financial measurements

Five events relating to liabilities are described below:

(a) Recorded a bi-weekly payroll, including the issuance of paychecks to employees. Amounts withheld from employees' pay and payroll taxes will be forwarded to appropriate agencies in the near future. (Ignore postretirement costs.)

(b) Made a monthly payment on a 12-month installment note payable, including interest and a partial repayment of the principal amount.

(c) Shortly before the maturity date of a six-month bank loan, made arrangements with the bank to refinance the loan on a long-term basis.

(d) Made an adjusting entry to record accrued interest payable on a 2-year bank loan (interest is paid monthly.)

(e) Made a year-end adjusting entry to amortize a portion of the discount on long-term bonds payable.

Indicate the immediate effects of each transaction or adjusting entry upon the financial measurements in the five column headings listed below. Use the code letters, I for increase, D for decrease, and NE for no effect.

Correct Answer:

Verified

Q143: Loss contingencies

Ocean to Coast Airlines could,at any

Q183: Bonds payable issued between interest dates -

Q192: The December 31, 2010, adjusting entry for

Q193: Bonds issued at discount or premium

On March

Q194: Rose Company's total payroll-related expense for the

Q194: Bond prices after issuance

Several years ago,Clear-Air Systems

Q195: What is the amount of interest expense

Q195: Deferred income taxes

At the end of its

Q197: Fully amortizing installment notes

When Sue Meadow purchased

Q201: Which of the following statements is (are)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents