Declining Balance Depreciation on July 6, 2011, Grayson Purchased New Machinery with an Machinery

Declining balance depreciation

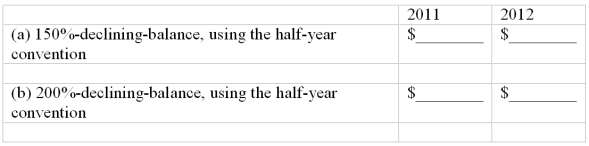

On July 6, 2011, Grayson purchased new machinery with an estimated useful life of 10 years. The cost of the equipment was $80,000, with a residual value of $8,000.

Compute the depreciation on this machinery in 2011 and 2012 using each of the following methods.

Correct Answer:

Verified

Q91: Glouchester Associates sold office equipment for cash

Q96: Refer to the information above. Assume that

Q97: Refer to the information above. Assume that

Q99: Refer to the information above. In the

Q102: Accounting terminology. Listed below are nine technical

Q103: Various depreciation methods-first year

On September 5,

Q106: In February 2012, Gemstone Industries purchased the

Q114: Clark Imports sold a depreciable plant asset

Q116: Mayer Instrumentation sold a depreciable asset for

Q127: Early in the current year,Amazon Co.purchased the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents