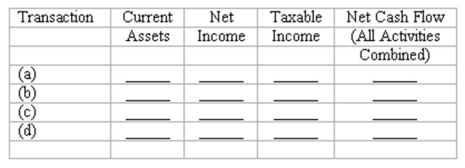

Four events pertaining to plant assets are described below.

(a) Computed depreciation for use in the annual income tax return (a different method is used in the financial statements).

(b) Made a year-end adjusting entry to record depreciation expense for financial reporting purposes.

(c) Sold old equipment for cash at a price below its book value, but above its income tax basis.

(d) Traded an old automobile in on a new one. The dealer granted a trade-in allowance on the old vehicle that was substantially above its book value and its tax basis. However, the trade-in allowance amounted to only a small portion of the price of the new car; most of the purchase price was paid in cash.

Indicate the immediate effects of each of these events upon the financial measurements in the four column headings listed below. Use the code letters, I for increase, D for decrease, and NE for no effect.

Note: Indicate only the immediate effects of each transaction. Do not attempt to anticipate how changes in taxable income will affect future cash flows.

Correct Answer:

Verified

Q125: Briefly explain the difference between a revenue

Q126: Effects of depreciation on income and cash

Q130: Assume Lloyd uses straight-line depreciation with the

Q133: Prepare journal entries for the following

Q136: Trade-ins

Dietz owned a delivery van with a

Q138: Depreciation; gains and losses in financial statements

In

Q139: Sayville Dairy sold a delivery truck for

Q140: Depreciation and disposal--a comprehensive problem

Domino, Inc uses

Q145: Gains and losses in financial statements and

Q147: Computation of goodwill

Chopin Corporation has net assets

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents