Write-off of uncollectible account receivable

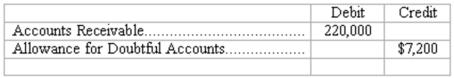

On January 10, Winston, Inc.'s trial balance included the following accounts:

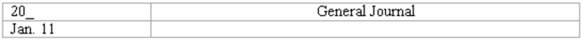

On January 11, Len Palmer, a major customer, declares bankruptcy and thus, Winston determines that a receivable from Palmer in the amount of $3,400 is worthless.

(a) In the space provided, prepare the journal entry that Winston should record to write-off the account receivable from Len Palmer on January 11.

(b) Compute the net realizable value of Winston's accounts receivable at each of the following dates:

January 10 (before write-off of Palmer's account) $_______________

January 11 (immediately after write-off of Palmers' account) $_______________

Correct Answer:

Verified

(b) Jan. 10: $220,0...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q169: Financial assets

(a. )Briefly explain what is meant

Q193: Bank reconciliation--computations and journal entry

The Cash account

Q195: Internal control over cash transactions

(a.) Describe three

Q196: Bank reconciliation

(A.) You are to complete the

Q196: Uncollectible accounts

(a. )What is an uncollectible account?

Q197: Balance sheet method-journal entries

The general ledger controlling

Q199: Reporting cash in the balance sheet

(a.) The

Q200: Bank reconciliation

At March 31, the balance of

Q202: You are to complete the June 30

Q203: Which of the following items is reported

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents