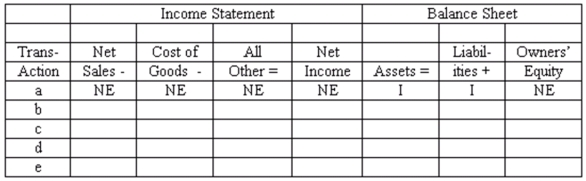

Effects of transactions upon the accounting equation Listed below are selected transactions of Simon's, a retail store which uses a perpetual inventory system:

(a) Purchased merchandise on account.

(b) Made an entry to recognize the revenue from a sale of merchandise on account. (Ignore the cost of goods sold.)

(c) Recognized the cost of goods sold relating to the sale in Transaction b.

(d) Collected in cash the account receivable from the customer in Transaction b.

(e) Following the taking of a physical inventory at year-end, made an adjusting entry to record a normal amount of inventory shrinkage.

Indicate the effects of each of these transactions upon the elements of the company's financial statements. Organize your answer in tabular form, using the column headings shown below. (Notice that the cost of goods sold is shown separately from all other expenses.) Use the code letters I for increase, D for decrease, and NE for no effect. The answer for Transaction a is provided as an example.

Correct Answer:

Verified

Q66: [The following information applies to the questions

Q93: Pet Foods Plus purchased bagged dog food

Q101: Accounting terminology

Listed below are nine technical accounting

Q103: Perpetual inventory system: transactions and closing

Q104: Gross profit The table below contains

Q105: Periodic inventory system Soundview Centre uses a

Q110: Subsidiary ledgers Listed below are several merchandising

Q112: If cost of goods sold is $360,000

Q119: Inventory systems

Briefly distinguish between a perpetual inventory

Q121: Gross profit rates a practical application

Note to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents