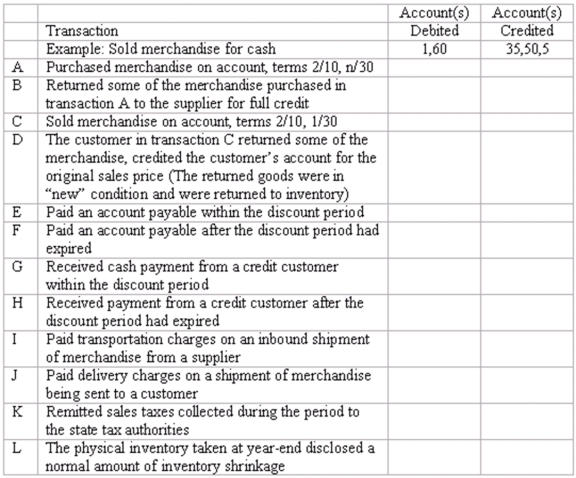

Journal entries for merchandising transactions Shown below is a partial chart of accounts for Main Street Markets, followed by a series of merchandising transactions. The company uses a perpetual inventory system, records purchases at net cost, and records sales at the full invoice price. Sales taxes are collected on all sales, and the sales tax liability is recorded immediately. Freight charges on inbound shipments are recorded in the Transportation-in account.

Indicate the accounts that should be credited in recording each transaction by placing the appropriate account number(s) in the space provided.

Correct Answer:

Verified

Q100: If Bounder Dog Supplies,Inc purchased inventory at

Q102: Inventory systems

Bookmarks,Inc.sells used books at its store

Q108: Inventory systems

Indicate whether you would expect each

Q113: Subsidiary ledgers

Explain the nature of subsidiary ledgers,and

Q115: Perpetual inventory system: basic entries Renato

Q116: Net sales and gross profit

Mayflower Supply House

Q120: Periodic inventory system Armstrong Creation uses a

Q121: The amount of costs transferred from the

Q121: The amount of costs transferred from the

Q123: Marietta Corporation uses a perpetual inventory system.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents