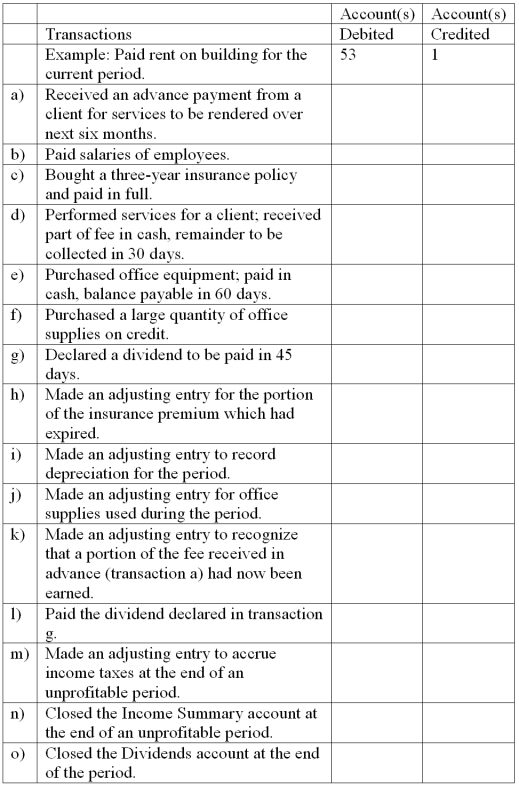

Adjustments and closing process--basic entries

Selected ledger accounts used by Goldstone Advertising, Inc., are listed along with identifying numbers. Following this list of account numbers and titles is a series of transactions. For each transaction, you are to indicate the proper accounts to be debited and credited.

Correct Answer:

Verified

Q109: Completion of worksheet--missing data

Certain data are given

Q110: Refer to the information above. The total

Q111: Preparation of financial statements

Using the Adjusted Trial

Q112: The following information is available: What is

Q113: The accounts and their amounts for

Q115: The December 31, 2011 worksheet for Albertville

Q116: Adjustments and closing process-basic entries

Selected ledger

Q117: Given the following information for the Maple

Q118: The following information is available: What is

Q119: Accounting terminology

Listed below are eight technical accounting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents