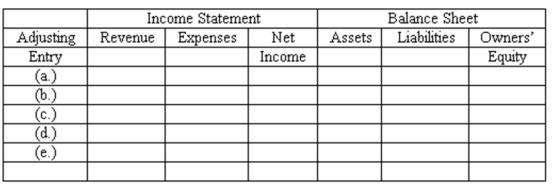

Adjusting entries-effect on elements of financial statements

Whoop-It-Up, Inc. prepares monthly financial statements. On March 31, the company's accountant made adjusting entries to record:

(A) Depreciation for the month of March.

(B) Amount owed to Whoop-It-Up, Inc for March from the concessionaire operating a juice bar in the facility. The amount due will be remitted to Whoop-It-Up, Inc during the first week in April.

(C) Cost of supplies used in March. (When purchased, the cost of supplies is debited to an asset account.)

(D) Earning of a portion of annual membership fees which had been collected in advance. (When customers purchase annual memberships, an Unearned Revenue account is credited.)

(E) Accrued interest for March owed on a bank loan obtained March 1. No interest expense has yet been recorded.

Indicate the effect of each of these adjusting entries on the major elements of the company's financial statements-that is, on revenue, expenses, net income, assets, liabilities, and owner's equity. Organize your answer in tabular form, using the column headings shown below and the symbols + for increase, - for decrease, and NE for no effect.

Correct Answer:

Verified

Q115: Purpose of adjusting entries

The president of Crown

Q117: Adjusting Entries

Identify four types of timing differences

Q127: What should be the December 31 balance

Q129: How much depreciation expense should be recognized

Q130: End-of-period adjustments-effect on net income

Ocean View, Inc.

Q131: End-of-period adjustments-effect on net income

Before making any

Q133: Accounting terminology

Listed below are nine technical

Q134: Adjusting entries-effect on elements of financial statements

Galaxy

Q135: Effects of errors on financial statements

Indicate the

Q137: Murphy's Auto Co. purchased a large piece

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents