End-of-period adjustments - selected computations

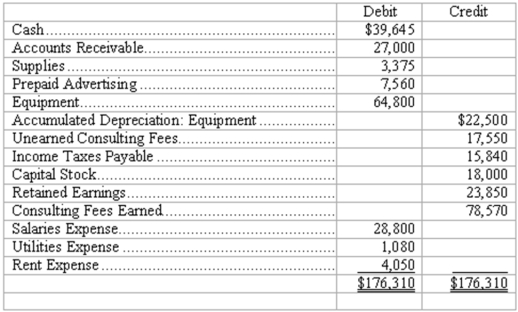

Allied Architects adjusts its books each month and closes its books at the end of the year. The trial balance at January 31, 2010, before adjustments is as follows:

The following information relates to month-end adjustments:

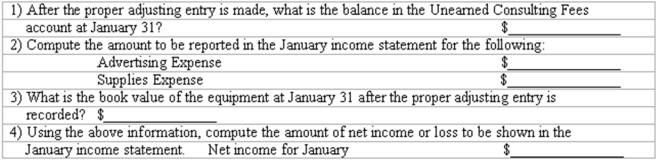

(a) According to contracts, consulting fees received in advance that were earned in January total $13,500.

(b) On November 1, 2009, the company paid in advance for 5 months' advertising in professional journals.

(c) At January 31, supplies on hand amount to $2,250.

(d) The equipment has an original estimated useful life of 4 years.

(e) The corporation is subject to income taxes of 25% of taxable income. (Assume taxable income is the same as "income before taxes.")

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q115: Purpose of adjusting entries

The president of Crown

Q118: Dolphin Co. received $1,500 in fees during

Q119: An asset purchased on January 1, 2006

Q120: At March 31, the amount of supplies

Q121: Adjusting entries

Selected ledger accounts used by

Q122: Adequate disclosure

(A.) Briefly explain what is meant

Q124: Adjusting entries

Selected ledger accounts used by

Q125: End-of-period adjustments

West Laboratory adjusts and closes its

Q127: Materiality

(A. )Identify several factors considered by an

Q127: What should be the December 31 balance

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents