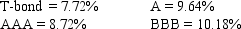

Assume that interest rates on 15-year noncallable Treasury and corporate bonds with different ratings are as follows:

The differences in rates among these issues were most probably caused primarily by:

A) Tax effects.

B) Default risk differences.

C) Maturity risk differences.

D) Inflation differences.

E) Real risk-free rate differences.

Correct Answer:

Verified

Q42: Which of the following statements is CORRECT?

A)

Q43: A 15-year bond has an annual coupon

Q44: Which of the following statements is CORRECT?

A)

Q45: A Treasury bond has an 8% annual

Q46: Bonds A, B, and C all have

Q48: You are considering three different bonds for

Q49: Which of the following statements is CORRECT?

A)

Q50: Which of the following statements is CORRECT?

A)

Q51: Bonds A and B are 15-year, $1,

Q52: Which of the following statements is CORRECT?

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents