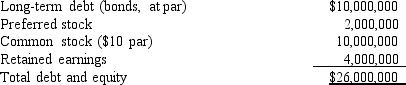

CMS Corporation's balance sheet as of today is as follows:

The bonds have a 4.0% coupon rate, payable semiannually, and a par value of $1, 000.They mature exactly 10 years from today.The yield to maturity is 12%, so the bonds now sell below par.What is the current market value of the firm's debt?

A) $5, 276, 731

B) $5, 412, 032

C) $5, 547, 332

D) $7, 706, 000

E) $7, 898, 650

Correct Answer:

Verified

Q77: Bond A has a 9% annual coupon,

Q78: Which of the following statements is CORRECT?

A)

Q79: Suppose International Digital Technologies decides to raise

Q80: Which of the following statements is CORRECT?

A)

Q81: If 10-year T-bonds have a yield of

Q83: The Gergen Group's 5-year bonds yield 6.85%,

Q84: Sommers Co.'s bonds currently sell for $1,

Q85: Meacham Enterprises' bonds currently sell for $1,

Q86: Curtis Corporation's noncallable bonds currently sell for

Q87: Perry Inc.'s bonds currently sell for $1,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents