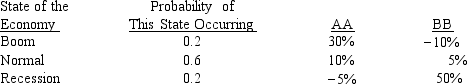

The distributions of rates of return for Companies AA and BB are given below:

We can conclude from the above information that any rational, risk-averse investor would be better off adding Security AA to a well-diversified portfolio over Security BB.

Correct Answer:

Verified

Q34: Even if the correlation between the returns

Q35: The slope of the SML is determined

Q36: Bad managerial judgments or unforeseen negative events

Q37: Portfolio A has but one security, while

Q38: A stock's beta measures its diversifiable risk

Q40: Any change in its beta is likely

Q41: The CAPM is a multi-period model that

Q42: If you plotted the returns on a

Q43: Which of the following statements is CORRECT?

A)

Q44: Assume that two investors each hold a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents