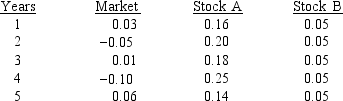

Consider the following average annual returns for Stocks A and B and the Market.Which of the possible answers best describes the historical betas for A and B?

A) bA > +1; bB = 0.

B) bA = 0; bB = -1.

C) bA < 0; bB = 0.

D) bA < -1; bB = 1.

E) bA > 0; bB = 1.

Correct Answer:

Verified

Q55: If markets are in equilibrium, which of

Q56: Your friend is considering adding one additional

Q57: Stock A's beta is 1.7 and Stock

Q58: If you plotted the returns of a

Q59: Stock A's beta is 1.7 and Stock

Q61: Ann has a portfolio of 20 average

Q62: If you randomly select stocks and add

Q63: Which of the following statements is CORRECT?

A)

Q64: In a portfolio of three randomly selected

Q65: Which of the following statements is CORRECT?

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents