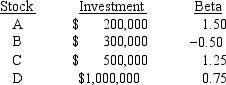

Consider the following information and then calculate the required rate of return for the Universal Investment Fund, which holds 4 stocks.The market's required rate of return is 13.25%, the risk-free rate is 7.00%, and the Fund's assets are as follows:

A) 9.58%

B) 10.09%

C) 10.62%

D) 11.18%

E) 11.77%

Correct Answer:

Verified

Q117: Which of the following statements is CORRECT?

A)

Q118: Assume that investors have recently become more

Q119: How would the Security Market Line be

Q120: Assume that the risk-free rate, rRF, increases

Q121: Sherrie Hymes holds a $200, 000 portfolio

Q123: Gardner Electric has a beta of 0.88

Q124: Megan Ross holds the following portfolio:

Q125: Paul McLaren holds the following portfolio:

Q126: Calculate the required rate of return for

Q127: Ivan Knobel holds a well-diversified portfolio that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents