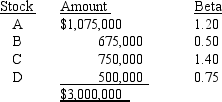

Joel Foster is the portfolio manager of the SF Fund, a $3 million hedge fund that contains the following stocks.The required rate of return on the market is 11.00% and the risk-free rate is 5.00%.What rate of return should investors expect (and require) on this fund?

A) 10.56%

B) 10.83%

C) 11.11%

D) 11.38%

E) 11.67%

Correct Answer:

Verified

Q136: Company A has a beta of 0.70,

Q137: Nystrand Corporation's stock has an expected return

Q138: Jenna holds a diversified $100, 000 portfolio

Q139: Martin Ortner holds a $200, 000 portfolio

Q140: Suppose Stan holds a portfolio consisting of

Q142: The $10.00 million mutual fund Henry manages

Q143: DHF Company has a beta of 1.5

Q144: Hazel Morrison, a mutual fund manager, has

Q145: Stuart Company's manager believes that economic conditions

Q146: Assume that your cousin holds just one

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents