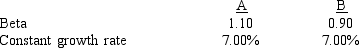

Stocks A and B have the following data.The market risk premium is 6.0% and the risk-free rate is 6.4%.Assuming the stock market is efficient and the stocks are in equilibrium, which of the following statements is CORRECT?

A) Stock A must have a higher dividend yield than Stock B.

B) Stock B's dividend yield equals its expected dividend growth rate.

C) Stock B must have the higher required return.

D) Stock B could have the higher expected return.

E) Stock A must have a higher stock price than Stock B.

Correct Answer:

Verified

Q34: Stocks A and B have the following

Q35: The required returns of Stocks X and

Q36: Which of the following statements is CORRECT?

A)

Q37: Stocks X and Y have the following

Q38: Which of the following statements is NOT

Q40: Merrell Enterprises' stock has an expected return

Q41: A stock is expected to pay a

Q42: 50 per share is the current price

Q43: Gere Furniture forecasts a free cash flow

Q44: If D? = $1.75, g (which is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents