An analyst wants to use the Black-Scholes model to value call options on the stock of Heath Corporation based on the following data:

•The price of the stock is $40.

•The strike price of the option is $40.

•The option matures in 3 months (t = 0.25) .

•The standard deviation of the stock's returns is 0.40, and the variance is 0.16.

•The risk-free rate is 6%.

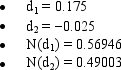

Given this information, the analyst then calculated the following necessary components of the Black-Scholes model:

N(d?) and N(d?) represent areas under a standard normal distribution function.Using the Black-Scholes model, what is the value of the call option?

A) $2.81

B) $3.12

C) $3.47

D) $3.82

E) $4.20

Correct Answer:

Verified

Q17: The strike price is the price that

Q18: If we define the "premium" on an

Q19: If the current price of a stock

Q20: Since investors tend to dislike risk and

Q21: Suppose you believe that Basso Inc.'s stock

Q23: Which of the following statements is CORRECT?

A)

Q24: The current price of a stock is

Q25: Which of the following statements is CORRECT?

A)

Q26: Which of the following statements is CORRECT?

A)

Q27: Suppose you believe that Florio Company's stock

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents