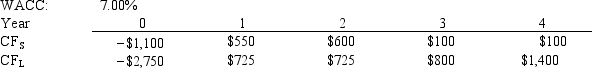

Langton Inc.is considering Projects S and L, whose cash flows are shown below.These projects are mutually exclusive, equally risky, and not repeatable.The CEO believes the IRR is the best selection criterion, while the CFO advocates the MIRR.If the decision is made by choosing the project with the higher IRR rather than the one with the higher MIRR, how much, if any, value will be forgone.In other words, what's the NPV of the chosen project versus the maximum possible NPV? Note that (1) "true value" is measured by NPV, and (2) under some conditions the choice of IRR vs.MIRR will have no effect on the value lost.

A) $185.90

B) $197.01

C) $208.11

D) $219.22

E) $230.32

Correct Answer:

Verified

Q96: Wiley's Wire Products is considering a project

Q97: Garner Inc.is considering a project that has

Q98: Craig's Car Wash Inc.is considering a project

Q99: Kiley Electronics is considering a project that

Q100: Westwood Painting Co.is considering a project that

Q102: Projects S and L, whose cash flows

Q103: Current Design Co.is considering two mutually exclusive,

Q104: Murray Inc.is considering Projects S and L,

Q105: Markman & Sons is considering Projects S

Q106: Farmer Co.is considering Projects S and L,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents