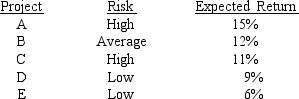

Laramie Labs uses a risk-adjustment when evaluating projects of different risk.Its overall (composite) WACC is 10%, which reflects the cost of capital for its average asset.Its assets vary widely in risk, and Laramie evaluates low-risk projects with a WACC of 8%, average-risk projects at 10%, and high-risk projects at 12%.The company is considering the following projects:

Which set of projects would maximize shareholder wealth?

A) A and B.

B) A, B, and C.

C) A, B, and D.

D) A, B, C, and D.

E) A, B, C, D, and E.

Correct Answer:

Verified

Q42: Collins Inc.is investigating whether to develop a

Q43: Which of the following rules is CORRECT

Q44: While developing a new product line, Cook

Q45: Which of the following statements is CORRECT?

A)

Q46: Which of the following procedures does the

Q48: Which one of the following would NOT

Q49: To increase productive capacity, a company is

Q50: You have just landed an internship in

Q51: Which of the following statements is CORRECT?

A)

Q52: Which of the following statements is CORRECT?

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents