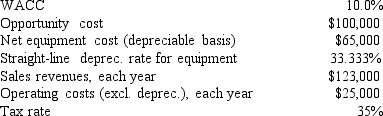

Century Roofing is thinking of opening a new warehouse, and the key data are shown below.The company owns the building that would be used, and it could sell it for $100, 000 after taxes if it decides not to open the new warehouse.The equipment for the project would be depreciated by the straight-line method over the project's 3-year life, after which it would be worth nothing and thus it would have a zero salvage value.No new working capital would be required, and revenues and other operating costs would be constant over the project's 3-year life.What is the project's NPV? (Hint: Cash flows are constant in Years 1-3.)

A) $10, 521

B) $11, 075

C) $11, 658

D) $12, 271

E) $12, 885

Correct Answer:

Verified

Q68: Taylor Inc., the company you work for,

Q69: DeVault Services recently hired you as a

Q70: Erickson Inc.is considering a capital budgeting project

Q71: Kasper Film Co.is selling off some old

Q72: McLeod Inc.is considering an investment that has

Q73: Fitzgerald Computers is considering a new project

Q74: Shultz Business Systems is analyzing an average-risk

Q75: Brandt Enterprises is considering a new project

Q77: VR Corporation has the opportunity to invest

Q78: Sheridan Films is considering some new equipment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents