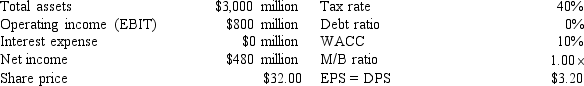

The following information has been presented to you about the Gibson Corporation.

The company has no growth opportunities (g = 0) , so the company pays out all of its earnings as dividends (EPS = DPS) .The consultant believes that if the company moves to a capital structure financed with 20% debt and 80% equity (based on market values) that the cost of equity will increase to 11% and that the pre-tax cost of debt will be 10%.If the company makes this change, what would be the total market value (in millions) of the firm?

A) $3, 200

B) $3, 600

C) $4, 000

D) $4, 200

E) $4, 800

Correct Answer:

Verified

Q55: Hernandez Corporation expects to have the following

Q56: Which of the following statements is CORRECT?

A)

Q57: LeCompte Learning Solutions is considering making a

Q58: Morales Publishing's tax rate is 40%, its

Q59: A new company to produce state-of-the-art car

Q61: Refer to Exhibit 15.3.BB is considering moving

Q62: Refer to Exhibit 15.1.Assume that PP is

Q63: Refer to Exhibit 15.3.Now assume that BB

Q64: Refer to Exhibit 15.4.The firm is considering

Q65: Refer to Exhibit 15.4.What is AJC's current

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents