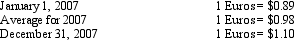

United owns Estada, a European based subsidiary for which the Euro is the functional currency. Estada had a net asset position at January 1, 2007 of 1,200,000 Euros and reported income of 350,000 Euros for 2007, which was earned evenly throughout the year. In addition, Estada paid 100,000 Euros of dividends at December 31, 2007. The following were in effect during 2007:

Determine the amount of the unrealized translation gain or loss United should record for 2007 with respect to Estada.

Determine the amount of the unrealized translation gain or loss United should record for 2007 with respect to Estada.

Correct Answer:

Verified

Q46: You are trying to determine the functional

Q47: Pop, Inc. acquires 100% of the outstanding

Q48: Coffee Comp. purchased 40% of the outstanding

Q50: Discuss the method of accounting for employee

Q51: Stock Trader, Inc. began operations in 2005.

Q53: Examine the five following cases and determine

Q71: Unrealized holding gains and losses from investments

Q74: Unrealized holding gains and losses from investments

Q91: When there are two or more investing

Q92: Although the organizational structure and operating policies

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents