NOTE: This Problem Requires Present Value Information As an Analyst You Wish to Restate Paperclip's Operating Leases

NOTE: This problem requires present value information.

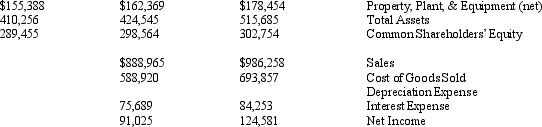

Paperclip Company manufactures office equipment and supplies throughout the U.S. The company owns property, plant, and equipment and also enters into operating leases for certain facilities. The company's tax rate is 35%. Listed below is selected financial data for Paperclip and the company's operating lease disclosure.

Papercli Conl.

Papercli Conl.

Operating Lease Dischsure

(amounts in thousands)

Operating Lease Comunitments

at the end of 2005

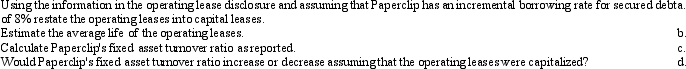

As an analyst you wish to restate Paperclip's operating leases into capital leases. Required:

Correct Answer:

Verified

Q25: Dividing a company's income tax expense by

Q48: Listed below are 12 accounting liabilities, place

Q50: Please answer the following questions about defined

Q51: Deferred tax liabilities result in future tax

Q53: Derivative instruments acquired to hedge exposure to

Q55: _ over sufficiently long time periods equals

Q56: GAAP requires firms to report the assets

Q58: Accountants use reserve accounts for various reasons,

Q60: When firms use derivatives effectively to manage

Q83: Many firms use derivative instruments to hedge

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents