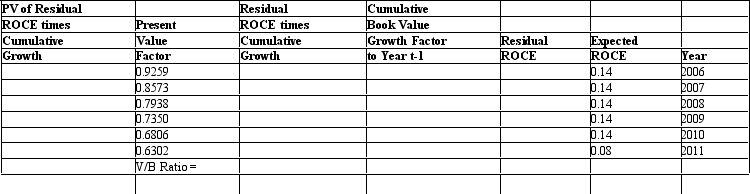

Assume an analyst is evaluating a firm with $1,000 of book value of common equity and a cost of equity capital equal to 8 percent. Assume that the analyst forecasts that the firm will earn ROCE of 14 percent until year 2011, when the firm will start earning ROCE equal to 8 percent. The company pays no dividends and will not engage in any stock transactions. Use this information to complete the following table and calculate the firm's value-to-book ratio.

Correct Answer:

Verified

Q22: The risk of the firm increases the

Q23: Economics teaches that,in equilibrium,firms will earn a

Q41: In research examining market efficiency,Bernard and Thomas

Q43: Compute the price-earnings ratio under the following

Q51: The process of _ stock prices assumes

Q52: What is the value of reverse engineering

Q54: Discuss how risk and profitability factors cause

Q54: The use of P/E ratios in valuation

Q55: A firm's value-to-book and market-to-book ratios may

Q57: What is a price differential and how

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents