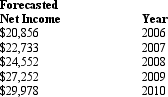

Jones Corp. Use this information to answer the following questions:

At the end of 2005 Jones Corp. developed the following forecasts of net income: Management believes that after 2010 Jones will grow at a rate of 7% each year. Total common shareholders' was $112,768 on December 31, 2005. Jones has not established a dividend and does not plan on paying dividends during 2006 to 2010, its cost of equity capital is 12%.

Management believes that after 2010 Jones will grow at a rate of 7% each year. Total common shareholders' was $112,768 on December 31, 2005. Jones has not established a dividend and does not plan on paying dividends during 2006 to 2010, its cost of equity capital is 12%.

Compute the value of Jones Corp. on January 1, 2006, using the residual income valuation model. Use the half-year adjustment.

A) $112,768

B) $185,329

C) $195,540

D) $133,624

Correct Answer:

Verified

Q2: Residual income will be zero when

A) the

Q7: Jones Corp. Use this information to answer

Q8: Jarrett Corp.

At the end of 2010

Q11: If an analyst expects a firm to

Q13: Residual income valuation focuses on:

A) dividend-paying capacity

Q15: If investors have invested $25,000 of common

Q16: At the beginning of 2007 investors had

Q18: Over the life of a firm,the capital

Q31: The value of a share of common

Q40: Residual income valuation focuses on _ as

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents