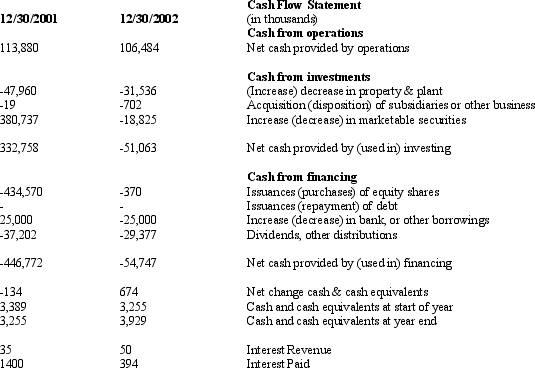

Below is information from the statement of cash flow and income statement for Graham Products, Inc. for 2002 and 2001. Marketable securities represent investments of excess cash that Graham Products does not need for operations. Graham Products' tax rate is 35%.

Using the above information calculate the amount of free cash flows to all debt and equity capital stakeholders for Graham Products for year 2002 and 2001.

Using the above information calculate the amount of free cash flows to all debt and equity capital stakeholders for Graham Products for year 2002 and 2001.

Correct Answer:

Verified

Q27: LA Sunglasses operates retail sunglass kiosks in

Q33: The forecasting and valuation process is particularly

Q35: For most firms,_ include cash and short-term

Q36: Changes in general price levels cause the

Q37: Steady-state growth in _ could be driven

Q39: Free cash flow from operations equals cash

Q46: When should an analyst use nominal cash

Q48: What three elements are needed to value

Q51: Discuss under which scenario it is appropriate

Q56: Provide the rationale for using expected free

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents