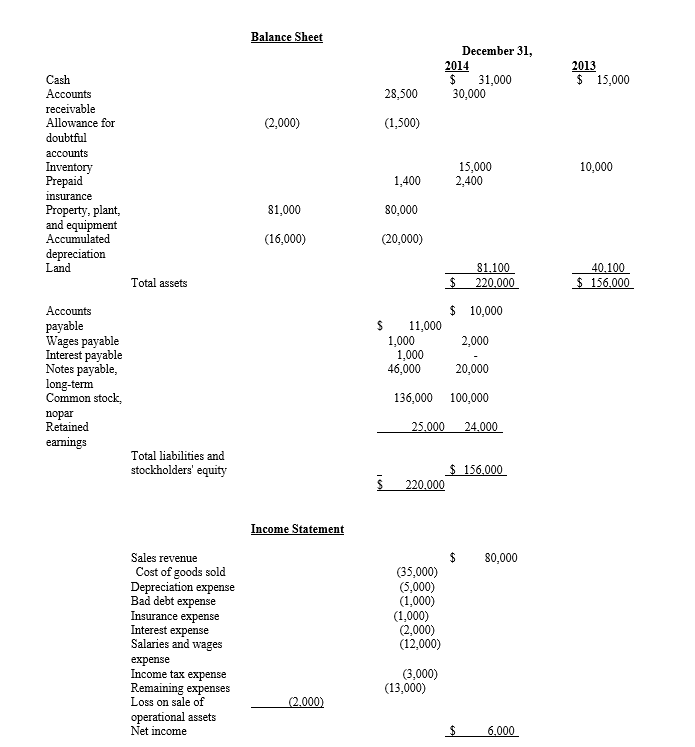

Financial information for Price Company at December 31, 2014, and for the year then ended, are presented below:

Additional information:

Additional information:

1. On December 31, 2013, Newton acquired 25 percent of Trent Corporation’s common stock for $137,500. On that date, the carrying value of Trent’s net assets and liabilities (which approximated fair value) was $550,000. Trent reported income of $60,000 for the year ended December 31, 2014. No dividend was paid on Trent’s common stock during the year.

2. During 2014, Newton loaned $150,000 to Dalton Company, an unrelated entity. Dalton made the first semi-annual principal payment of $15,000, plus interest at 10 percent, on October 1, 2014.

3. On January 2, 2014, Newton sold equipment costing $30,000, with a carrying value of $17,500, for $20,000 cash.

4. On January 2, 2014, Newton entered into a capital lease for an office building. The present value of the annual rental payments is $200,000, which equals the fair value of the building. Newton made the first lease payment of $30,000 when due on January 2, 2015.

5. Newton’s net income for 2014 was $180,000.

6. Newton declared and paid cash dividends for 2014 and 2013 as follows:

Required:

Prepare the statement of cash flows using the indirect method.

Correct Answer:

Verified

Q119: The extent to which a firm adjusts

Q120: The extent to which a firm adjusts

Q121: The product life-cycle concept from microeconomics and

Q122: The product life-cycle concept from microeconomics and

Q123: The product life-cycle concept from microeconomics and

Q125: The extent to which a firm adjusts

Q126: The product life-cycle concept from microeconomics and

Q127: The extent to which a firm adjusts

Q128: The product life-cycle concept from microeconomics and

Q129: The product life-cycle concept from microeconomics and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents