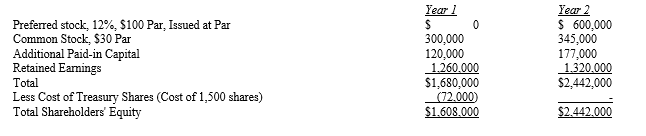

Selected data from the comparative balance sheets of Mock Company as of December 31, Year 1, and Year 2 appear below:

The following transactions occurred during Year 2:

The following transactions occurred during Year 2:

a. March 1, Year 2: The company resold the Treasury shares on the market for $57 per share.

b. June 30, Year 2: The company declared and issued a 10-percent stock dividend at a time when the market price was $63 per share.

c. September 15, Year 2: The company issued additional shares of common stock on the open market for cash.

d. November 16, Year 2: The company issued new preferred shares on the open market for cash.

e. December 31, Year 2: Net income for Year 2 was $195,000. The company declared and paid cash dividends of $72,000 on the last day of the year.

Required:

Prepare journal entries for each of the transactions and events affecting these shareholders' equity accounts during Year 2.

Correct Answer:

Verified

Q159: Which of the following is not true

Q160: Which of the following is true?

A)Employees receive

Q161: Which of the following is/are true concerning

Q162: The data below are from the December

Q163: Prepare journal entries for the following transactions:

a.Issue

Q165: Alfonsio Corp.has an extensive stock option program

Q166: Stock warrants outstanding should be classified as

A)liabilities.

B)reductions

Q167: Prepare journal entries to record each of

Q168: Prepare journal entries to record each of

Q169: Which of the following is/are true concerning

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents