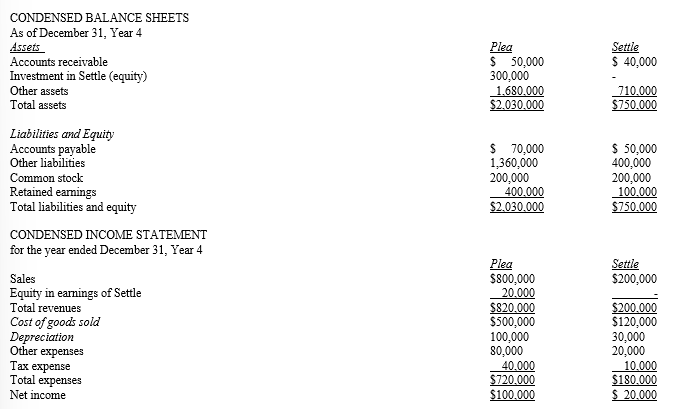

Given the following separate company balance sheets and income statements, answer the following questions.

Additional information:

Plea acquired its investment in the stock of Settle on the date of Settle’s incorporation.

Consolidated accounts receivable is $80,000.

Consolidated sales total $900,000.

No purchases from Settle remain in Plea’s ending inventory.

Required:

a. What percentage of Settle does Plea appear to own?

b. What is beginning retained earnings of Plea?

c. How much was Plea’s initial investment in Settle?

d. What is the amount of intercompany accounts receivable?

e. What is consolidated cost of goods sold?

Correct Answer:

Verified

Q80: U.S.GAAP view investments of over 50 percent

Q81: Describe the U.S.GAAP requirement in accounting for

Q82: Describe the accounting and reporting of investments

Q83: The adjusted, preclosing trial balances of Pie

Q84: Given the following consolidated balance sheet and

Q86: Describe the accounting for minority, active investments.

Q87: Describe U.S.GAAP and IFRS requirements in accounting

Q88: What is a noncontrolling interest in a

Q89: Variable interest entities have what characteristics?

Q90: Parent Computer Corporation acquired significant influence over

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents