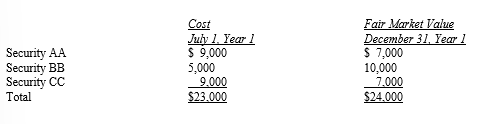

Short-term marketable equity securities were acquired on July 1, Year 1 for $23,000, and classified as available-for-sale.On December 31, Year 1, the securities had a market value of $24,000, determined as follows:  What adjustment is required to reflect December 31, Year 1 fair value?

What adjustment is required to reflect December 31, Year 1 fair value?

A) unrealized holding gain on available-for-sale securities of $1,000, reported in other comprehensive income

B) unrealized holding gain on available-for-sale securities of $1,000, reported in the income statement

C) realized holding gain on available-for-sale securities of $1,000, reported in the income statement

D) realized holding gain on available-for-sale securities of $1,000, reported in other comprehensive income

E) realized holding gain on available-for-sale securities of $1,000, reported in retained earnings

Correct Answer:

Verified

Q59: ValleyView Company ValleyView Company acquires common stock

Q60: Marco Insurance Marco Insurance acquired shares of

Q61: ValleyView Company ValleyView Company acquires common stock

Q62: Information concerning Manley Company's portfolio

Q63: ValleyView Company ValleyView Company acquires common stock

Q65: Which of the following would most likely

Q66: U.S.GAAP classifies securities that are neither debt

Q67: Lightner Company decides that an available-for-sale security

Q68: U.S.GAAP requires firms holding minority, passive investments

Q69: Which of the following is/are elements of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents