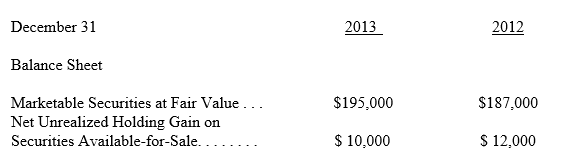

During 2013, Maria Corporation sold marketable securities for $14,000 that had a carrying value of $13,000 at the time of sale.The financial statements of Maria Corporation reveal the following

information with respect to securities available-for-sale:

2013

Income Statement

Realized Gain on Sale of Securities Available-for-Sale ... $4,000

a.What was the acquisition cost of the marketable securities sold?

b.What was the unrealized holding gain on the securities sold at the time of sale?

c.What was the unrealized holding gain during 2013 on securities still held by the end of 2013?

d.What was the cost of marketable securities purchased during 2013?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q119: U.S.GAAP and IFRS require firms to account

Q120: Which of the following is/aretrue?

A)Both U.S.GAAP and

Q121: What are derivative instruments and how are

Q122: Bartow Company acquires common stock of Champion

Q123: How are securities measured at acquisition?

Q125: Martin Company acquired $500,000 face value of

Q126: What are elements of a derivative?

Q127: What is the accounting treatment for trading

Q128: Discuss the accounting for debt securities held

Q129: How are securities measured after acquisition?

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents