Financial ratios

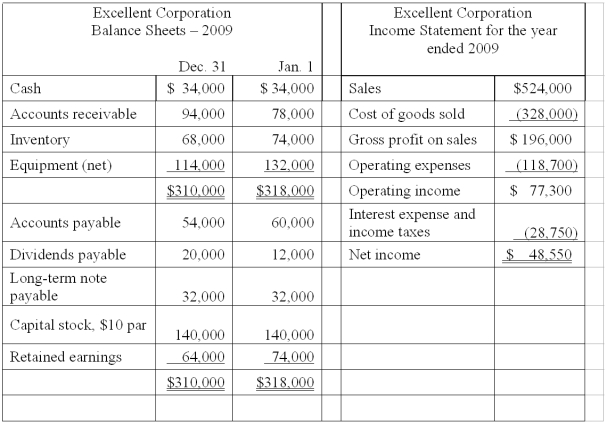

Given below are comparative balance sheets and an income statement for the Excellent Corporation:

All sales were made on account. Cash dividends declared during the year totaled $58,550. Compute the following:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q121: Percentage changes; p/e ratios and investors'

Q122: Effects of transactions upon analytical measurements

Determine

Q123: Measures of solvency and credit risk

Shown

Q125: Use and interpretation of financial measurements

Shown

Q126: Eleva Corporation's days to sell the average

Q128: Current ratio and working capital

The balance

Q129: Eleva Corporation's days to collect accounts receivable

Q130: Namekagon Corporation's return on common stockholders' equity

Q131: Financial ratios

Shown below are some key

Q132: Namekagon Corporation's interest coverage ratio for 2011

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents