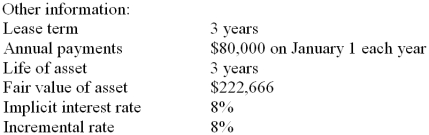

Python Company leased equipment from Hope Leasing on January 1, 2009. Hope purchased the equipment at a cost of $222,666.

There is no expected residual value.

Required:

Prepare appropriate journal entries for Python for 2009. Assume straight-line depreciation and a December 31 year-end.

Correct Answer:

Verified

Q72: If the residual value of a leased

Q76: When a capital lease is first recorded

Q80: On January 1, 2009, Packard Corporation leased

Q82: On December 31, 2009, B Corp. sold

Q84: Required:

1. Calculate the amount to be recorded

Q85: On January 1, 2009, Salvatore Company leased

Q86: On January 1, 2009, Holbrook Company leased

Q87: On December 31, 2009, Perry Corporation leased

Q88: Southern Edison Company leased equipment from Hi-Tech

Q92: In a sale-leaseback arrangement,the lessee is also:

A)The

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents