In its 2001 annual report to shareholders, Maytag Corporation included the following disclosures in its income statement and related footnotes:

Special Charges and Loss on Securities

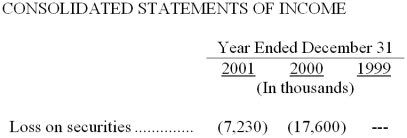

During the fourth quarter of 2001, the Company recorded special charges and loss on securities totaling $17.0 million, or $13.5 million after-tax. Special charges of $9.8 million, or $6.2 million after-tax, were associated with a salaried workforce reduction of approximately 250 employees. Cash expenditures for 2001 related to this charge were $3.7 million. Loss on securities of $7.2 million resulted from the write-down of the remaining investment in a privately held Internet-related company.

During the fourth quarter of 2000, the Company recorded special charges and loss on securities totaling $57.5 million, or $36.5 million after-tax. Special charges of $39.9 million, or $25.3 million after-tax, were associated with terminated product initiatives, asset write-downs and executive severance costs related to management changes. Loss on securities of $17.6 million, or $11.2 million after-tax, resulted from a lower market valuation of securities of TurboChef Technologies, Inc. and investments in privately held Internet-related Companies .. The loss on securities charge of $17.6 million was non-cash.

Required:

Discuss the possible rationale behind the losses on securities reported by Maytag in 2000 and 2001.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q133: According to SFAS No. 159, companies can

Q134: On January 1, 2009, American Corporation purchased

Q137: On July 1, 2009, Silverwood Company purchased

Q138: When an investor owns 20% to 50%

Q139: Assume Gibson company is an equal partner

Q140: Jaycom Enterprises has invested its excess cash

Q166: Discuss the following questions.

Required:

What securities must be

Q174: From time to time,debt and equity securities

Q176: Sometimes companies change the extent to which

Q178: Many corporations own more than 50% of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents