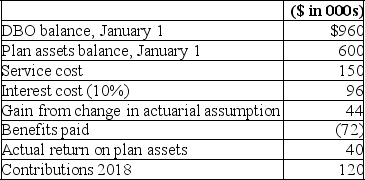

Dharma Initiative, Inc., has a defined benefit pension plan. Characteristics of the plan during 2018 are as follows:  The expected long-term rate of return on plan assets was 8%. There were no AOCI balances related to pensions on January 1, 2018, but at the end of 2018, the company amended the pension formula creating a prior service cost of $24 million. Dharma Initiative prepares its financial statements according to International Financial Reporting Standards (IFRS).

The expected long-term rate of return on plan assets was 8%. There were no AOCI balances related to pensions on January 1, 2018, but at the end of 2018, the company amended the pension formula creating a prior service cost of $24 million. Dharma Initiative prepares its financial statements according to International Financial Reporting Standards (IFRS).

Required:

1. Calculate the pension expense for 2018.

2. Prepare the journal entry to record pension expense, gains or losses, past service cost, funding, and payment of benefits for 2018.

3. What amount will Dharma Initiative report in its 2018 balance sheet as a net pension asset or net pension liability?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q223: Pension plans typically require some minimum period

Q224: Bazerman Inc. has a postretirement health

Q225: Differentiate between the projected benefit obligation, the

Q226: What is different about the expected postretirement

Q227: What are the possible components of pension

Q229: The components of postretirement benefit expense are

Q230: What is the theoretical and practical trade-off

Q231: In its 2018 annual report to

Q232: Differentiate between a defined contribution pension plan

Q233: Dharma Initiative, Inc, has a defined benefit

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents