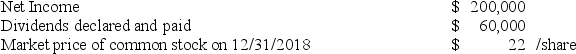

Assume that, on January 1, 2018, Matsui Co. paid $1,200,000 for its investment in 60,000 shares of Yankee Inc. Further, assume that Yankee has 200,000 total shares of stock issued. The book value and fair value of Yankee's identifiable net assets were both $4,000,000 at January 1, 2018. The following information pertains to Yankee during 2018:  What amount would Matsui report in its year-end 2018 balance sheet for its investment in Yankee?

What amount would Matsui report in its year-end 2018 balance sheet for its investment in Yankee?

A) $1,320,000.

B) $1,260,000.

C) $1,242,000.

D) None of these answer choices are correct.

Correct Answer:

Verified

Q90: When the equity method of accounting for

Q91: On April 1, 2018, BigBen Company acquired

Q92: Jack Corporation purchased a 20% interest in

Q93: Which of the following increases the investment

Q94: When the investor's level of influence changes,

Q96: Consolidated financial statements are prepared when one

Q97: Sox Corporation purchased a 40% interest in

Q98: The equity method of accounting for investments

Q99: Gerken Company concluded at the beginning of

Q100: If Pop Company owns 15% of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents