Assume that, on January 1, 2018, Sosa Enterprises paid $3,000,000 for its investment in 36,000 shares of Orioles Co. Further, assume that Orioles has 120,000 total shares of stock issued and estimates an eight-year remaining useful life and straight-line depreciation with no residual value for its depreciable assets. At January 1, 2018, the book value of Orioles' identifiable net assets was $7,000,000, and the fair value of Orioles was $10,000,000. The difference between Orioles' fair value and the book value of its identifiable net assets is attributable to $1,800,000 of land and the remainder to depreciable assets. Goodwill was not part of this transaction.

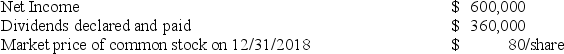

The following information pertains to Orioles during 2018:  What amount would Sosa Enterprises report in its year-end 2018 balance sheet for its investment in Orioles Co.?

What amount would Sosa Enterprises report in its year-end 2018 balance sheet for its investment in Orioles Co.?

A) $3,200,000.

B) $3,180,000.

C) $3,135,000.

D) $3,027,000.

Correct Answer:

Verified

Q105: At the start of the current year,

Q106: Under IAS No. 39, which is not

Q107: If the fair value of a held-to-maturity

Q108: Which of the following is not true

Q109: Which of the following is not true

Q111: Which of the following is not true

Q112: Which of the following is not true

Q113: Which of the following is not true

Q114: When an impairment of an investment that

Q115: Under IFRS No. 9, which is not

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents