In its 20X4 annual report to shareholders, Honemark Corporation included the following disclosures in its income statement and related footnotes:

CONSOLIDATED STATEMENTS OF INCOME  Special Charges and Loss on Securities

Special Charges and Loss on Securities

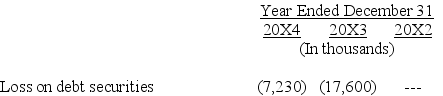

During the fourth quarter of 20X4, the Company recorded special charges and loss on debt securities totaling $17.0 million, or $13.5 million after-tax. Special charges of $9.8 million, or $6.2 million after-tax, were associated with a salaried workforce reduction of approximately 250 employees. Cash expenditures for 20X4 related to this charge were $3.7 million. Loss on debt securities of $7.2 million resulted from the write-down of the remaining investment in bonds of an Internet-related company.

During the fourth quarter of 20X3, the Company recorded special charges and loss on debt securities totaling $57.5 million, or $36.5 million after-tax. Special charges of $39.9 million, or $25.3 million after-tax, were associated with terminated product initiatives, asset write-downs, and executive severance costs related to management changes. Loss on debt securities of $17.6 million, or $11.2 million after-tax, resulted from a lower market valuation of debt securities of TurboChief Technologies, Inc., and debt investments in bonds of Internet-related Companies ….. The loss on debt securities charge of $17.6 million was noncash.

Required:

Discuss the possible rationale behind the losses on securities reported by Maytag in 20X3 and 20X4.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q164: Stanhope Associates accounts for the following investments

Q165: Assume Gibson Company is an equal partner

Q166: Discuss the following questions.

Required:

What securities must be

Q167: In early December of 2018, Blue Corp.

Q168: Matrix, Inc., acquired 25% of Neo Enterprises

Q170: Newjohn Company owns stock in several affiliated

Q171: From time to time, debt securities must

Q172: Jaycom Enterprises has invested its excess cash

Q173: On January 1, 2017, Bactin Corporation acquired

Q174: In early December of 2018, Blue Corp.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents