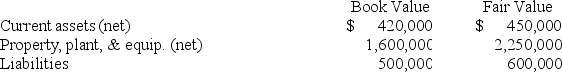

Juliana Corporation purchased all of the outstanding stock of Caldwell Inc., paying $2,700,000 cash. Juliana assumed all of the liabilities of Caldwell. Book values and fair values of acquired assets and liabilities were:  Juliana would record goodwill of:

Juliana would record goodwill of:

A) $1,180,000.

B) $600,000.

C) $880,000.

D) $100,000.

Correct Answer:

Verified

Q35: Montana Mining Co. (MMC) paid $200

Q36: Vijay Inc. purchased a three-acre tract of

Q37: Lake Incorporated purchased all of the

Q38: Assets acquired in a lump-sum purchase are

Q39: Asset retirement obligations:

A) Increase the balance in

Q41: The basic principle used to value an

Q42: An asset acquired using a long-term note

Q43: On July 1, 2018, Markwell Company acquired

Q44: Assets acquired under multi-year deferred payment contracts

Q45: Simpson and Homer Corporation acquired an office

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents