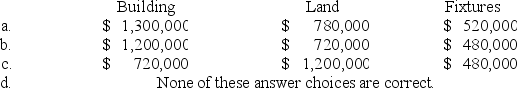

Simpson and Homer Corporation acquired an office building on three acres of land for a lump-sum price of $2,400,000. The building was completely furnished. According to independent appraisals, the fair values were $1,300,000, $780,000, and $520,000 for the building, land, and furniture and fixtures, respectively. The initial values of the building, land, and furniture and fixtures would be:

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q40: Juliana Corporation purchased all of the outstanding

Q41: The basic principle used to value an

Q42: An asset acquired using a long-term note

Q43: On July 1, 2018, Markwell Company acquired

Q44: Assets acquired under multi-year deferred payment contracts

Q46: Assets acquired by the issuance of equity

Q47: The fixed-asset turnover ratio provides:

A) The rate

Q48: On June 17, the Lattern Company issued

Q49: On September 30, 2018, Corso Steel acquired

Q50: Donated assets are recorded at:

A) Zero (memo

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents