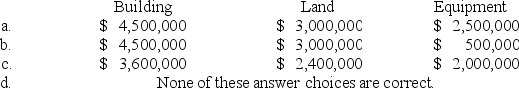

Cantor Corporation acquired a manufacturing facility on four acres of land for a lump-sum price of $8,000,000. The building included used but functional equipment. According to independent appraisals, the fair values were $4,500,000, $3,000,000, and $2,500,000 for the building, land, and equipment, respectively. The initial values of the building, land, and equipment would be:

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q50: Donated assets are recorded at:

A) Zero (memo

Q51: On September 30, 2018, Corso Steel acquired

Q52: Savings Mart is a national retail chain.

Q53: On July 1, 2018, Markwell Company acquired

Q54: Braxwell Corporation acquired the following assets associated

Q56: The balance sheets of Davidson Corporation reported

Q57: Maltese is a privately-owned company. On September

Q58: On September 30, 2018, Corso Steel acquired

Q59: On January 1, 2018, Laramie Inc. acquired

Q60: A company receiving a donated asset will

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents