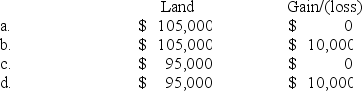

Horton Stores exchanged land and cash of $5,000 for similar land. The book value and the fair value of the land were $90,000 and $100,000, respectively. Assuming that the exchange lacks commercial substance, Horton would record land-new and a gain/(loss) of:

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q64: Interest may be capitalized:

A) On routinely manufactured

Q65: Interest is eligible to be capitalized as

Q66: On June 1, 2017, the Crocus

Q67: In a nonmonetary exchange of equipment, if

Q68: P. Chang & Co. exchanged land and

Q70: On June 1, 2017, the Crocus

Q71: Below is information relative to an

Q72: In computing capitalized interest, average accumulated expenditures:

A)

Q73: Interest is not capitalized for:

A) Assets that

Q74: Alamos Co. exchanged equipment and $18,000 cash

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents