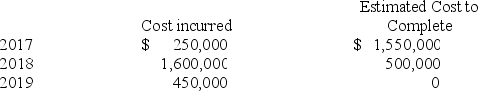

JRE2 Inc. entered into a contract to install a pipeline for a fixed price of $2,200,000. JRE2 recognizes revenue upon contract completion.

-In 2017, JRE2 would report (rounded to the nearest thousand) gross profit (loss) of:

A) $0.

B) $(100,000) .

C) $56,000.

D) $73,000.

Correct Answer:

Verified

Q169: Arizona Desert Homes (ADH) constructed a new

Q170: Arizona Desert Homes (ADH) constructed a new

Q171: Which of the following is not true

Q172: A rationale for recognizing revenue over the

Q173: With respect to delaying revenue recognition until

Q175: Arizona Desert Homes (ADH) constructed a new

Q176: Revenue on a long-term contract should not

Q177: Indiana Co. began a construction project in

Q178: Which of the following is true about

Q179: JRE2 Inc. entered into a contract to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents